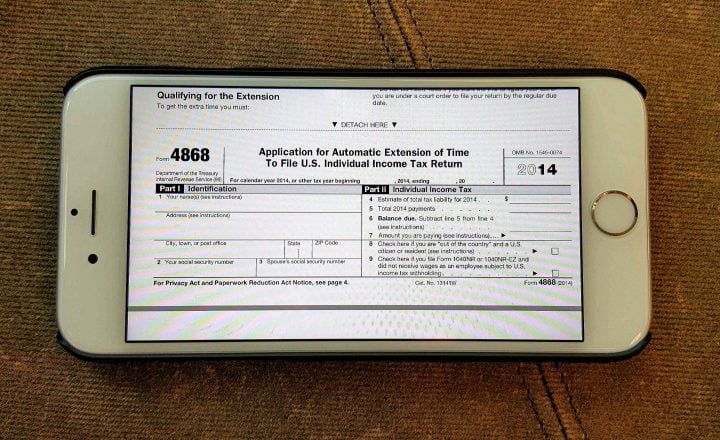

Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment)įorm 4768 Application for Extension of Time to File a Return and/or Pay U.S. You can see if one of these applies.įorm 2350 Application for Extension of Time to File U.S. April 18 Is Irs Tax Deadline For 2022 Jan.Can I File For An ExtensionDue To Emancipation Day, And Patriots Day, The Deadlines For When I Can File My Tax Returns For 2022 Are Extended To 2022.What We Found The Irs Confirmed This Year’s April 18 Deadline In.May 17 (Monday) 2022 Date. Now, if you do not fit under the above categories, below are the remaining possible forms to fill out for an extension. If you are a business or corporation, you will want to fill out a Form 7004 (Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns) or Form 1138 (Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback). You will get a confirmation number for your records. The IRS explains that by doing this you will not have to file a separate extension form. Then indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or a credit/debit card. In addition, you can also get an extension if you pay all or some of your estimated income tax due. To qualify for a tax extension, you must file the appropriate form by the standard tax filing deadline of Ap(or Ap. Otherwise, you can fill out the Form 4868, which is the Application for Automatic Extension of Time To File U.S. The tax extension deadline is the regular tax deadline. But Emancipation Day a Washington, D.C., holiday. Typically, the tax deadline falls on April 15. If you don’t pay the amount due by the regular due date for Form 709, you’ll owe interest and may also be charged penalties.

2016 tax extension when due free#

If you would like to e-file for an extension via Free File Software, there are many options on the official IRS website. However, your tax payment is still due by April 18 and can be submitted with the extension form. An extension of time to file your 2016 calendar year income tax return also extends the time to file Form 7. When filing for a free tax return extension, you will have six extra months to file your return, with Octoas your new deadline. How You Can Help Ukraine: Verified Charities, GoFundMe & Ways to Support Ukrainians

0 kommentar(er)

0 kommentar(er)